Economy: Feb-26 Inflation Expected at 6.5% YoY

Published February 27, 2026KOHC: 2QFY26 EPS clocks in at PKR 2.82, down by 21% YoY

Published February 25, 2026FCCL: 2QFY26 EPS clocks in at PKR 1.64, flattish YoY

Published February 25, 2026MLCF: 2QFY26 EPS clocks in at PKR 2.98, down by 16% YoY

Published February 25, 2026KSE-100 INDEX: Demand Cluster in Focus (Technical Weekly)

Published February 23, 2026KSE-100 INDEX: Retracement Phase Tests Structural Support (Technical Weekly)

Published February 16, 2026PIOC: 2QFY26 EPS clocks in at PKR 7.04, down 9% YoY

Published February 11, 2026KSE-100 INDEX: Follow-Through Reinforces Cautious Stance (Technical Weekly)

Published February 9, 2026KSE-100 INDEX: Corrective Risk Builds After Extended Run (Technical Weekly)

Published February 2, 2026Economy: Jan-26 Inflation Expected at 6.0% YoY

Published January 30, 2026Cement Universe to Post Earnings of PKR 12.4bn in 2QFY26, down 18% YoY

Published January 30, 2026Economy: SBP maintains Status quo at 10.5%

Published January 26, 2026SAZEW: 2QFY26 EPS expected to clock in at PKR 94, up by 136% YoY, DPS PKR 26

Published January 26, 2026KSE-100 INDEX: Trend Strengthens After Supply Absorption (Technical Weekly)

Published January 26, 2026KSE-100 INDEX: Pullback Absorbed, Uptrend Structure Holds (Technical Weekly)

Published January 19, 2026KSE-100 INDEX: Uptrend Slows as Resistance Caps Momentum (Technical Weekly)

Published January 12, 2026KSE-100 INDEX: Strength Continues Within Rising Channel (Technical Weekly)

Published January 5, 2026Economy: Dec-25 NCPI Expected at 5.8% YoY

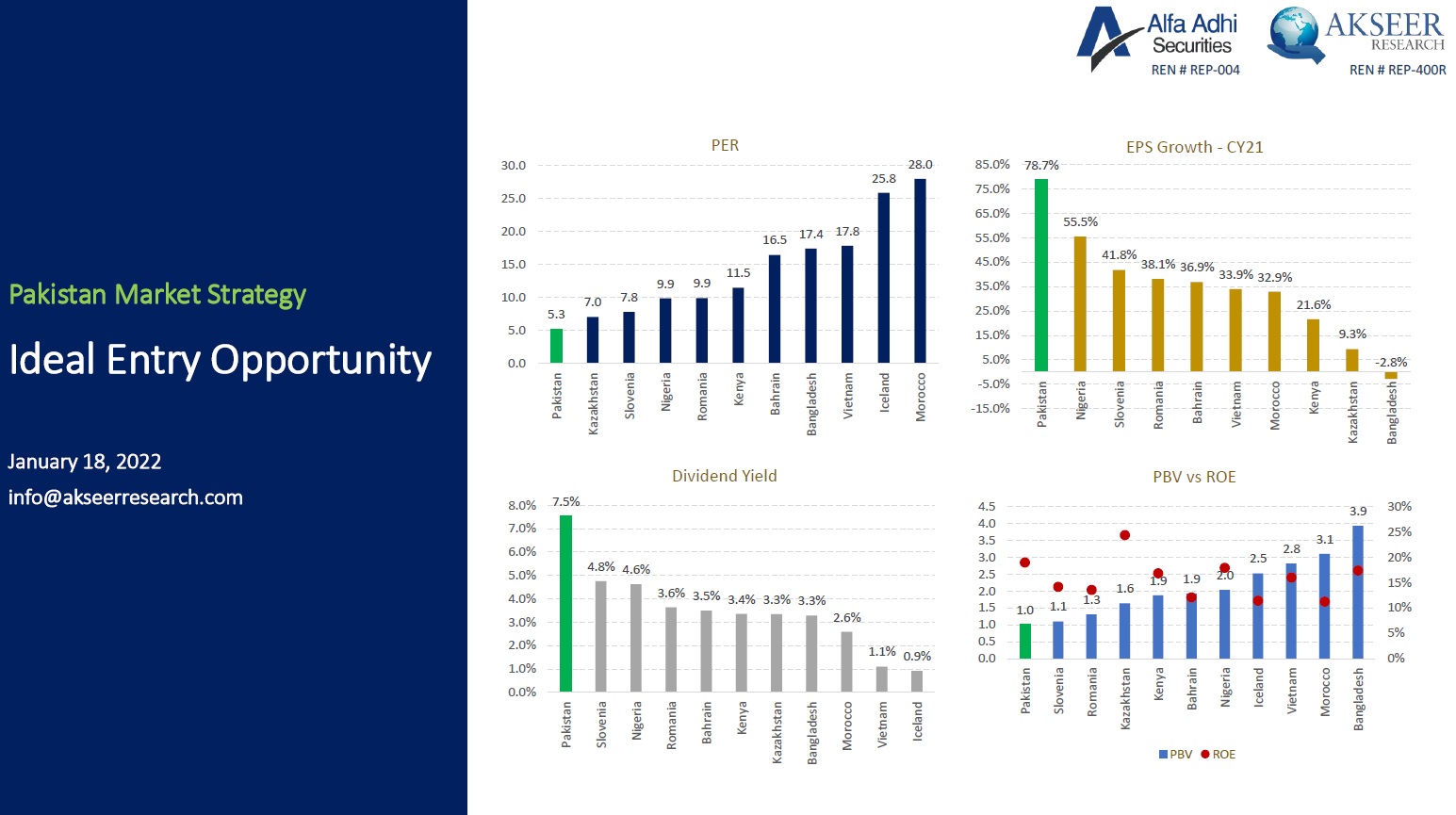

Published December 31, 2025Strategy: Transitioning from Survival to Growth

Published December 31, 2025KSE-100 INDEX: Bullish Structure with Measured Follow-Through (Technical Weekly)

Published December 29, 2025KSE-100 INDEX: Momentum Holds Within Rising Channel (Technical Weekly)

Published December 22, 2025EPCL: Reversal Structure Unfolds (Flash Note | Pakistan Technicals)

Published December 19, 2025PIBTL: Gushing The Saucer (Flash Note | Pakistan Technicals)

Published December 18, 2025Economy: SBP slashes policy rate by 50bps

Published December 15, 2025KSE-100 INDEX: Renewed Strength Signals Continuation Potential (Technical Weekly)

Published December 15, 2025KSE-100 INDEX: Momentum Builds as Market Awaits Confirmation (Technical Weekly)

Published December 8, 2025KSE-100 INDEX: Bullish Tone Reemerges After Key Reclaim (Technical Weekly)

Published December 1, 2025Economy: Nov-25 NCPI Expected at 6.4% YoY

Published November 28, 2025Economy: Inflation Risk Real or Just a Fear?

Published November 28, 2025KSE-100 INDEX: Sideways Phase Continues with Cautious Tone (Technical Weekly)

Published November 24, 2025KSE-100 INDEX: Bulls Defend Base, Momentum Still Soft (Technical Weekly)

Published November 17, 2025KSE-100 INDEX: Pullback Deepens Amid Waning Momentum (Technical Weekly)

Published November 10, 2025KSE-100 INDEX: Gap-Up Rally Signals Momentum Revival (Technical Weekly)

Published November 3, 2025Economy: Oct-25 NCPI Expected at 5% YoY

Published October 29, 2025Economy: SBP maintains policy rate at 11%

Published October 27, 2025KSE-100 INDEX: Steady Uptrend Consolidates before Next Move (Technical Weekly)

Published October 27, 2025SAZEW: PHEV Expansion and Cost Discipline Driving Growth Uphill

Published October 24, 2025KSE-100 INDEX: Trend Resilient as Bulls Hold Key Support (Technical Weekly)

Published October 20, 2025KSE-100 INDEX: Resistance Halts Advance, Supports in Focus (Technical Weekly)

Published October 13, 2025KSE-100 INDEX: Rising Channel Points to Extended Upside (Technical Weekly)

Published October 6, 2025KSE-100 INDEX: Rally Extends Toward Channel Top (Technical Weekly)

Published September 29, 2025PIOC: 4QFY25 EPS clocks in at PKR 4.98 down by 16% YoY, DPS PKR 10.0

Published September 26, 2025KSE-100 INDEX: Uptrend Strong with Room to Extend (Technical Weekly)

Published September 22, 2025Economy - SBP maintains policy rate at 11%.

Published September 16, 2025KSE-100 INDEX: Shooting Star Hints at Near-Term Caution (Technical Weekly)

Published September 15, 2025KSE-100 INDEX: Rising Channel Fuels Continued Rally (Technical Weekly)

Published September 8, 2025KSE-100 INDEX: Market Consolidates After Multi-Week Rally (Technical Weekly)

Published September 1, 2025Economy: Aug-25 NCPI expected at 3.7% YoY

Published August 27, 2025KSE-100 INDEX: Market Extends Gains, Eyes Next Resistance Zone (Technical Weekly)

Published August 25, 2025KSE-100 INDEX: Uptrend Intact with Caution of Pullback (Technical Weekly)

Published August 18, 2025Pakistan's Motorcycle Revival: Demographics Meet Economic Recovery

Published August 15, 2025KSE-100 INDEX: Bulls in Control, Eyes on Next Leg (Technical Weekly)

Published August 11, 2025KSE-100 INDEX: Channel Momentum Drives Bullish Continuation (Technical Weekly)

Published August 4, 2025Economy: SBP maintains policy rate at 11%.

Published July 31, 2025Economy: Jul-25 NCPI expected at 2.9% YoY

Published July 29, 2025KSE-100 INDEX: Momentum Stays Strong, But Overheated (Technical Weekly)

Published July 28, 2025KSE-100 INDEX: Bullish Momentum Persists, Resistance Test Ahead (Technical Weekly)

Published July 21, 2025KSE-100 INDEX: Upward Drive Tests Higher Extension Targets (Technical Weekly)

Published July 14, 2025KSE-100 INDEX: Bullish Extension Eyes Next Breakout Zone (Technical Weekly)

Published July 7, 2025KSE-100 INDEX: Bullish Engulfing Revives Uptrend Momentum (Technical Weekly)

Published June 30, 2025KSE-100 INDEX: Downside Risks Mounting After Reversal Candle (Technical Weekly)

Published June 23, 2025Economy: SBP maintains policy rate at 11%

Published June 16, 2025KSE-100 INDEX: Island Reversal Threatens Uptrend Continuation (Technical Weekly)

Published June 16, 2025Economy: MPC likely to keep the policy rate unchanged

Published June 13, 2025Federal Budget FY26: Reforming Where It Hurts

Published June 11, 2025KSE-100 INDEX: Bullish Signal Strengthens After Consolidation (Technical Weekly)

Published June 10, 2025KSE-100 INDEX: Indecision Near Highs, Trend Intact (Technical Weekly)

Published June 2, 2025KSE-100 INDEX: Uptrend Holds, Breakout Awaits (Technical Weekly)

Published May 26, 2025KSE-100 INDEX: Rally Gains Steam Amid Caution Signals (Technical Weekly)

Published May 19, 2025KSE-100 INDEX: Cautious Rebound within a Weakening Trend (Technical Weekly)

Published May 12, 2025Economy: SBP slashes policy rate by 100bps to 11%

Published May 5, 2025KSE-100 INDEX: Support Cluster Holds, but Momentum Weakens (Technical Weekly)

Published May 5, 2025Economy: MPC likely to cut policy rate by 50bps

Published May 2, 2025OCTOPUS: Bullish Setup Forms Near Long-Term Trendline (Flash Note | Pakistan Technicals)

Published April 30, 2025KSE-100 INDEX: Momentum Fades as Range-bound Action Persists (Technical Weekly)

Published April 28, 2025Economy: Apr-25 NCPI expected at 0.2% YoY

Published April 25, 2025KSE-100 INDEX: Price Recovers, Yet Uptrend Awaits Validation (Technical Weekly)

Published April 21, 2025KSE-100 INDEX: Rising Risks After RSI Breakdown (Technical Weekly)

Published April 14, 2025KSE-100 INDEX: Bullish Structure, But Signs of Fatigue (Technical Weekly)

Published April 7, 2025KSE-100 INDEX: Momentum Strong, But Key Resistance in Play (Technical Weekly)

Published March 24, 2025KSE-100 INDEX: Positive Momentum Builds, Resistance in Sight (Technical Weekly)

Published March 17, 2025Economy: SBP maintains policy rate at 12%

Published March 10, 2025KSE-100 INDEX: Holds Key Levels, Needs Volume for Next Leg (Technical Weekly)

Published March 10, 2025KSE-100 INDEX: Consolidation Persists, Struggles for Momentum (Technical Weekly)

Published March 3, 2025PPL: 2QFY25 EPS clocks in at PKR 10.02, down by 32% YoY, DPS PKR 2.00

Published February 28, 2025OGDC: 2QFY25 EPS clocks in PKR 9.63, down by 44% YoY, DPS PKR 4.05

Published February 28, 2025PPL: 2QFY25 EPS expected at PKR 7.34, down by 33% YoY, DPS PKR 2.00

Published February 25, 2025OGDC: 2QFY25 EPS expected to clock in at PKR 9.03, down by 48% YoY, DPS PKR 3.00

Published February 25, 2025KSE-100 INDEX: Holds Support but Lacks Upward Conviction (Technical Weekly)

Published February 24, 2025Economy: Feb-25 NCPI expected at 1.8% YoY

Published February 20, 2025DGKC & MLCF: Trends & Relative Performance (Flash Note | Pakistan Technicals)

Published February 19, 2025SSGC: Tweezer Bottom, Reversal Likely (Flash Note | Pakistan Technicals)

Published February 19, 2025KSE-100 INDEX: Faces Resistance Amid Weak Momentum (Technical Weekly)

Published February 17, 2025DGKC: Long & Short-term Formations (Flash Note | Pakistan Technicals)

Published February 12, 2025KSE100: Gauging The Balance (Flash Note | Pakistan Technicals) Alpha - Akseer Research

Published February 12, 2025KSE-100 INDEX: Weak Volumes & RSI Signal Further Downside (Technical Weekly)

Published February 10, 2025OMCs: Higher growth ahead, Still a Buy

Published February 7, 2025KSE-100 INDEX: Holds Key Support, Resistance Caps Gain (Technical Weekly)

Published February 3, 2025PPL: Morning Star Pattern Signals Potential Recovery (Flash Note | Pakistan Technicals)

Published January 31, 2025AGL: Rejected at Resistance, Downside Risks Grow (Flash Note | Pakistan Technicals)

Published January 30, 2025MARI: Inverted Hammer Signals Potential Reversal (Flash Note | Pakistan Technicals)

Published January 30, 2025Economy: SBP slashes policy rate by 100bps to 12%

Published January 27, 2025Revenue surplus expected to drop to PKR 4bn (Flash Note | Pakistan Research)

Published January 27, 2025KSE-100 INDEX: Key Levels Define Next Move (Technical Weekly)

Published January 27, 2025KSE-100 Index: Bearish Signals Emerged, Caution Ahead (Flash Note | Pakistan Technicals)

Published January 23, 2025KSE-100 INDEX: Short-Term Recovery Likely, Caution Ahead (Technical Weekly)

Published January 20, 2025KSE-100 INDEX: Faces Correction, Recovery Potential Ahead (Technical Weekly)

Published January 13, 2025OGDC: The Leader’s Revival

Published January 8, 2025KSE-100 INDEX: Faces Congestion at Key Resistance (Technical Weekly)

Published January 6, 2025KSE-100 INDEX: Lower Highs, Declining Volume Signal Weakness (Technical Weekly)

Published December 30, 2024Economy: Dec-24 NCPI expected at 4.3% YoY, lowest since Apr-18

Published December 27, 2024KSE-100 INDEX: Piercing Line Suggests Short-Term Reversal (Technical Weekly)

Published December 23, 2024PPL: Deriving value from improved cash positions Inbox

Published December 19, 2024Economy: SBP slashes policy rate by 200bps to 13%

Published December 17, 2024KSE-100 INDEX: Index at New Highs, Momentum Intact (Technical Weekly)

Published December 16, 2024KSE-100 INDEX: Extends Gains, Tests Key Fibonacci Resistance (Technical Weekly) Inbox

Published December 9, 2024KSE-100 INDEX: Crosses 100K with Renewed Strength (Technical Weekly)

Published December 2, 2024Economy: Nov-24 NCPI expected at 4.5% YoY

Published November 29, 2024KSE-100 INDEX: Long Upper Shadow Doji Signals Reversal Risk (Technical Weekly)

Published November 25, 2024KSE-100 INDEX: KSE-100 Approaches Key Fibonacci Resistance (Technical Weekly)

Published November 18, 2024KSE-100 INDEX: Holds above Resistance Line on New Highs (Technical Weekly)

Published November 11, 2024Economy: SBP slashes policy rate by 250bps to 15%

Published November 5, 2024TRG: Bullish Momentum Building within Bearish Channel (Flash Note | Pakistan Technicals)

Published November 4, 2024KSE-100 INDEX: Holds New Highs, Traces Resistance Trendline (Technical Weekly)

Published November 4, 2024MARI: 1QFY25 EPS clocks in at PKR 15.99, 0% YoY, DPS 0.00

Published October 30, 2024MCB: 9MCY24 Corporate Briefing Takeaways

Published October 29, 2024PPL: 1QFY25 EPS clocks in at PKR 8.67, down by 21% YoY, DPS PKR 2.00

Published October 29, 2024AKBL: 3QCY24 EPS clocks in at PKR 4.11, up 4% YoY

Published October 29, 2024Economy: Oct-24 NCPI expected at 7.2% YoY

Published October 29, 2024AKBL: 3QCY24 EPS to clock in at PKR 3.52, down 11% YoY

Published October 28, 2024PPL: 1QFY25 EPS expected at PKR 7.13, down by 35% YoY, DPS PKR 1.00

Published October 28, 2024KSE-100 INDEX: Bullish Momentum Meets Resistance at 90K (Technical Weekly)

Published October 28, 2024OGDC: 1QFY25 EPS clocks in at PKR 9.54, down by 16% YoY, DPS PKR 3.00

Published October 25, 2024BAFL: 9MCY24 Corporate Briefing Takeaways

Published October 25, 2024BAHL: 3QCY24 EPS clocks in at PKR 10.77, up 7% YoY, DPS PKR 3.50

Published October 24, 2024BAHL: 3QCY24 EPS to clock in at PKR 10.98, up 9% YoY, DPS PKR 3.50

Published October 24, 2024MCB: 3QCY24 EPS clocks in at PKR 13.94, down 5% YoY, DPS PKR 9.00

Published October 23, 2024UBL: 3QCY24 EPS clocks in at PKR 20.86, up 76% YoY, DPS PKR 11.00

Published October 23, 2024MCB: 3QCY24 EPS to clock in at PKR 13.22, down 10% YoY, DPS PKR 9.00

Published October 23, 2024UBL: 3QCY24 EPS to clock in at PKR 14.35, up 21% YoY, DPS PKR 11.00

Published October 23, 2024MEBL: 3QCY24 EPS clocks in at PKR 14.36, up 1% YoY, DPS PKR 7.00

Published October 21, 2024MEBL: 3QCY24 EPS to clock in at PKR 16.34, up 15% YoY, DPS PKR 7.00

Published October 21, 2024KSE-100 INDEX: Caution Ahead: Key Support at Risk (Technical Weekly)

Published October 21, 2024BAFL: 3QCY24 EPS clocks in at PKR 8.26, up 51% YoY; DPS PKR 2.00

Published October 18, 2024BAFL: 3QCY24 EPS to clock in at PKR 6.45, up 18% YoY; DPS PKR 2.00

Published October 16, 2024HBL: 3QCY24 EPS clocks in at PKR 9.85, down 13% YoY; DPS PKR 4.00

Published October 16, 2024HBL: 3QCY24 EPS to clock in at PKR 10.83, down 4% YoY; DPS PKR 4.00

Published October 16, 2024KSE-100 INDEX: Rising to reconnect the trendlines (Technical Weekly)

Published October 14, 2024HUBC: Caught between a rock and a hard place

Published October 10, 2024HUBC: Pitfalls and Setbacks (Flash Note | Pakistan Technicals)

Published October 9, 2024PSO's bailout: First sign of the circular debt resolution

Published October 8, 2024KSE-100 INDEX: Momentum Builds for Renewed Upside (Technical Weekly)

Published October 7, 2024Economy: Sep-24 NCPI drops to 6.91% YoY

Published October 2, 2024Economy: Government initiates first debt buyback

Published October 1, 2024KSE-100 INDEX: Struggling to Hold Breakout (Technical Weekly)

Published September 30, 2024Economy: Sep-24 NCPI expected at 7.6% YoY - lowest since Jan-21

Published September 26, 2024KSE-100 INDEX: Rounds off Bullish Breakout, Eyes 87K (Technical Weekly)

Published September 23, 2024KSE-100 INDEX: Break of 79,327 Needs Follow-Through (Technical Weekly)

Published September 16, 2024Economy: SBP slashes policy rate by 200bps to 17.5%

Published September 13, 2024KSE-100 INDEX: Ascending Triangle in Play (Technical Weekly)

Published September 9, 2024NPL: 4QFY24 EPS clocks in at PKR 4.33, up by 25% YoY, DPS PKR 5.00

Published September 3, 2024NCPL: FY24 EPS clocks in at PKR 13.37, up 24% YoY

Published September 3, 2024Economy: Aug-24 NCPI arrives at 9.64% YoY, single-digit after 3 years

Published September 3, 2024Tech Flash - INIL: Series of Negatives (Flash Note | Pakistan Technicals)

Published September 3, 2024NCPL: 4QFY24 EPS expected to clock in at PKR 4.02, up 21% YoY, DPS PKR 7.25

Published September 2, 2024APL: FY24 EPS clocked in at PKR 111.09, Up 11% YoY; DPS PKR 17.50

Published September 2, 2024Systems Limited: 1HCY24 Corporate Briefing Takeaways

Published September 2, 2024NPL: 4QFY24 EPS expected to clock in at PKR 4.14, up by 20% YoY, DPS PKR 4.50

Published September 2, 2024POL: FY24 EPS clocks in at PKR 137.93, up by 7% YoY, DPS PKR 70.00

Published September 2, 2024KSE-100 INDEX: Caution Advised amid Stalemate (Technical Weekly)

Published September 2, 2024AKBL: 2QCY24 EPS clocks in at PKR 3.01, up 5% YoY

Published August 29, 2024POL: FY24 EPS expected at PKR 132.18, up by 3% YoY, DPS PKR 55.00

Published August 29, 2024APL: FY24 EPS expected at PKR 105.98, Up 6% YoY; DPS PKR 19.00

Published August 29, 2024SYS: 1HCY24 EPS clocks in at PKR 11.12, down 39% YoY

Published August 29, 2024AKBL: 2QCY24 EPS to clock in at PKR 2.44, down 14% YoY

Published August 28, 2024Trend lines & Averages (Flash Note | Pakistan Technicals)

Published August 28, 2024EFERT: Bearish Outlook below Key Support (Flash Note | Pakistan Technicals)

Published August 28, 2024PSO: FY24 EPS clocks in at PKR 33.79, Up 1.80x YoY; DPS PKR 10.00

Published August 27, 2024SYS: 2QCY24 EPS to clock in at PKR 6.5, up 34% YoY

Published August 27, 2024FCCL: 4QFY24 EPS clocks in at PKR 0.48, up 2.50x YoY

Published August 27, 2024MCB: 2QCY24 Corporate Briefing Takeaways

Published August 27, 2024Economy: Aug-24 NCPI expected to arrive at 9.8% YoY, marking a 34-month low

Published August 26, 2024HBL: 2QCY24 EPS clocks in at PKR 9.81, up 11% YoY; DPS PKR 4.00

Published August 26, 2024KSE-100 INDEX: Moves Stall Post Wedge Breakout (Technical Weekly)

Published August 26, 2024PSO: FY24 EPS is expected at PKR 23.77, Up 83% YoY; DPS PKR 5.00

Published August 23, 2024BAFL: 2QCY24 Corporate Briefing Takeaways

Published August 22, 2024CHCC: 4QFY24 EPS clocks in at PKR 4.40, up 9.15x YoY, DPS PKR 4.00

Published August 22, 2024HBL: 2QCY24 EPS to clock in at PKR 10.11, up 14% YoY; DPS PKR 4.00

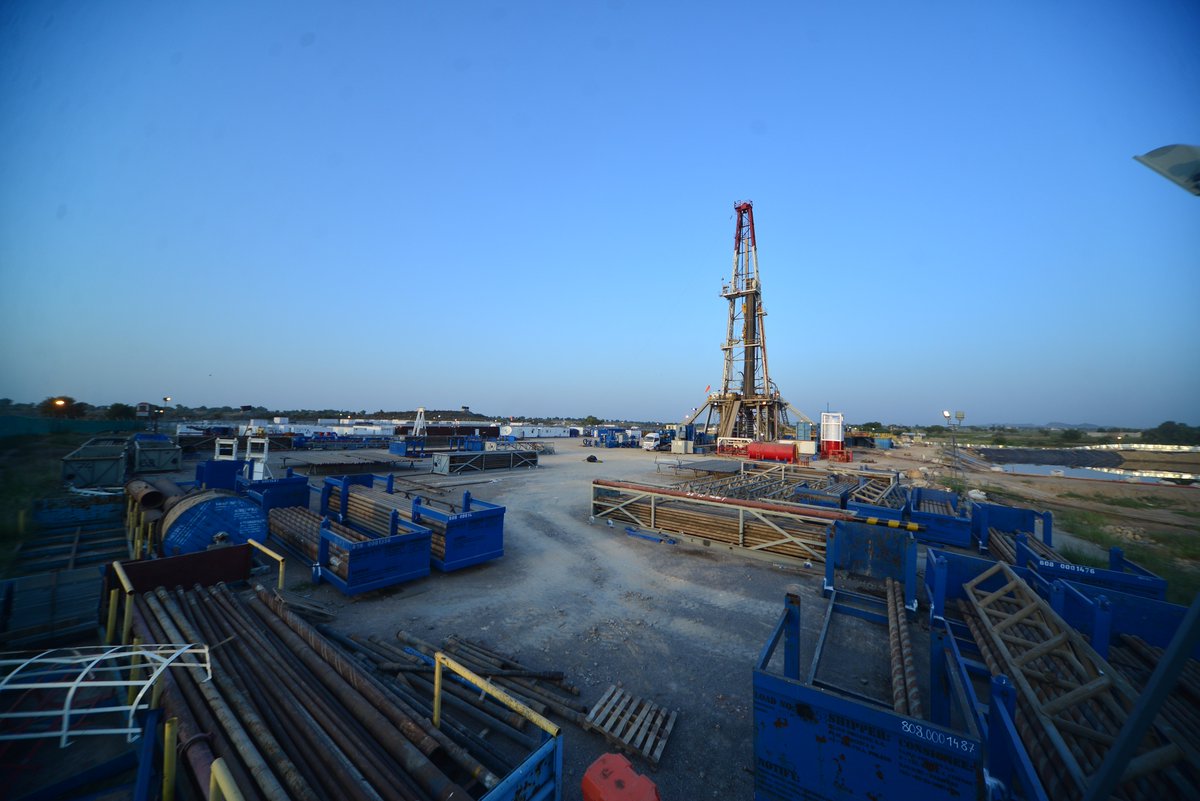

Published August 21, 2024TAL Block: Razgir-01 encounters additional hydrocarbon flows (Flash Note | Pakistan Research)

Published August 19, 2024CHCC: 4QFY24 EPS expected to clock in at PKR 6.21, up 13x YoY, DPS PKR 3.0

Published August 19, 2024MEBL: 2QCY24 Corporate Briefing Takeaways

Published August 19, 2024Peaks in place: GHNI & GAL (Flash Note | Pakistan Research)

Published August 19, 2024KSE-100 INDEX: Faces Rejection, Cautious Outlook Advised (Technical Weekly)

Published August 19, 2024NPL: Payouts to increase on strong cashflow generation

Published August 15, 2024FCCL: 4QFY24 EPS is expected at PKR 0.73, up 3.82x YoY

Published August 13, 2024KSE-100 INDEX: Breather in Downtrend, Caution Advised (Technical Weekly)

Published August 12, 2024MARI: 4QFY24 EPS clocks in at PKR 192, up by 62% YoY, DPS PKR 134

Published August 8, 2024MEBL: 2QCY24 EPS clocks in at PKR 14.88, up 55% YoY, DPS PKR 7.00

Published August 8, 2024BAHL: 2QCY24 EPS clocks in at PKR 10.24, up 50% YoY, DPS PKR 3.50

Published August 7, 2024MEBL: 2QCY24 EPS to clock in at PKR 14.08, up 47% YoY, DPS PKR 7.00

Published August 7, 2024MCB: 2QCY24 EPS clocks in at PKR 12.98, up 13% YoY, DPS PKR 9.00

Published August 7, 2024MARI: 4QFY24 EPS expected to clock in at PKR 111, down 6% YoY, DPS PKR 51

Published August 6, 2024MCB: 2QCY24 EPS to clock in at PKR 13.12, up 14% YoY; DPS PKR 9.00

Published August 6, 2024BAHL: 2QCY24 EPS to clock in at PKR 8.12, up 19% YoY, DPS PKR 3.50

Published August 6, 2024KSE-100 INDEX: Surviving the Support Line (Technical Weekly)

Published August 5, 2024BAFL: 2QCY24 EPS clocks in at PKR 6.79, up 36% YoY, DPS PKR 2.00

Published August 1, 2024UBL: 2QCY24 EPS clocks in at PKR 11.32, up 12% YoY; DPS 11.00

Published July 31, 2024EFERT: 2QCY24 EPS clocked in at PKR 1.25, up 57% YoY; DPS PKR 3.00

Published July 31, 2024FFC: 2QCY24 EPS clocked in at PKR 12.22, up 2.91x YoY; DPS PKR 10.00

Published July 30, 2024Economy: SBP Post-MPS Analyst Briefing: Key Takeaways

Published July 30, 2024FFC: 2QCY24 EPS expected to clock in at PKR 11.5, up 2.74x YoY; DPS PKR 8.10

Published July 29, 2024EFERT: 2QCY24 EPS likely to clock in at PKR 2.68; DPS PKR 3.00

Published July 29, 2024BAFL: 2QCY24 EPS likely to clock in at PKR 4.86, down by 3% YoY

Published July 29, 2024TAL Block: Razgir-01 encounters hydrocarbon flows (Flash Note | Pakistan Research)

Published July 29, 2024Economy: Jul-24 NCPI expected to further soften to 10.6% YoY

Published July 29, 2024KSE-100 INDEX: Rising Wedge – An Exhaustion In The Making (Technical Weekly)

Published July 29, 2024UBL: 2QCY24 EPS to clock in at PKR 9.21, down 9% YoY; DPS PKR 11.00

Published July 25, 2024FFBL: 2QCY24 EPS clocked in at PKR 4.84, up 13x YoY

Published July 25, 2024LUCK: The Cyclical Swings (Flash Note | Pakistan Technicals)

Published July 25, 2024NCPL: Corrective Move Nears Critical Support (Flash Note | Pakistan Technicals)

Published July 25, 2024FFBL: 2QCY24 EPS likely to clock in at PKR 3.60, up 9.7x

Published July 24, 2024FABL: Accumulation Opportunity (Flash Note | Pakistan Technicals)

Published July 24, 2024KSE-100 INDEX: Bearish Engulfing Pattern Signals Potential Reversal (Technical Weekly)

Published July 22, 2024GTYR: Awaiting the Broader Breakout (Flash Note | Pakistan Technicals)

Published July 19, 2024POL: Jhandial-03 encounters encouraging hydrocarbon flows (Flash Note | Pakistan Research)

Published July 15, 2024MFL: Approaching Demand Zone (Flash Note | Pakistan Technicals)

Published July 15, 2024KSE-100 INDEX: Tracking Channel Resistance (Technical Weekly)

Published July 15, 2024DGKC: Poised for Broader Upside (Flash Note | Pakistan Technicals)

Published July 12, 2024ATRL: Elements of a Trend (Flash Note | Pakistan Technicals)

Published July 9, 2024KSE-100 INDEX: Maintaining Upward Trajectory (Technical Weekly)

Published July 8, 2024PIAHCLA: Recovery Persists (Flash Note | Pakistan Technicals)

Published July 4, 2024SNGP: The Cup & Handle (Flash Note | Pakistan Technicals)

Published July 3, 2024Economy: Jun-24 NCPI clocked in at 12.6% YoY

Published July 2, 2024KSE-100 INDEX: Support Holds Amid Low Momentum (Technical Weekly)

Published July 1, 2024Economy: Slight uptick expected in NCPI at 12.6% YoY

Published June 28, 2024SEARL: Defining Moment for Support (Flash Note | Pakistan Technicals)

Published June 27, 2024PIAHCLA: Bottoming Out with Upside Potential (Flash Note | Pakistan Technicals)

Published June 25, 2024KSE-100 INDEX: Staying Positive above Key Support Levels (Technical Weekly)

Published June 24, 2024KSE-100 INDEX: Cautious Optimism (Technical Weekly)

Published June 20, 2024SEARL: Hope & Reality (Flash Note | Pakistan Technicals)

Published June 13, 2024Federal Budget FY25: Striking the nerve center of undocumented economy

Published June 13, 2024SAZEW: Caution Recommended (Flash Note | Pakistan Technicals)

Published June 13, 2024KSE-100 Index | Pakistan Technical Market Update Inbox

Published June 13, 2024KSE100 Index: Brewing Short-term Risks (Flash Note | Pakistan Technicals)

Published June 13, 2024KSE100-Index: Trends & Slopes (Flash Note | Pakistan Technicals) Inbox

Published June 13, 2024KSE-100 INDEX: The 50-day SMA Halts Drop (Technical Weekly) Inbox

Published June 13, 2024KSE-100 index: Potential for Setting New Highs (Technical Weekly) Inbox

Published June 13, 2024AGL: Approaching Key Support Levels (Flash Note | Pakistan Technicals) Inbox

Published June 13, 2024GTYR: Await Correction Completion for Buy Signals (Flash Note | Pakistan Technicals) Inbox

Published June 13, 2024IMAGE: Optimal Entry Points and Targets (Flash Note | Pakistan Technicals) Inbox

Published June 13, 2024PIBTL: Support and Resistance Zones (Flash Note | Pakistan Technicals) Inbox

Published June 13, 2024Economy: SBP cuts policy rate for the first time since Jun-20

Published June 13, 2024OMCs: Industry volumes increase 7% YoY in May-24, 11MFY24 decline now stands at 9%

Published June 13, 2024Economy: May-24 NCPI arrives at a 30-month low

Published June 13, 2024Economy: Inflation to drop sharply in May due to lower food prices

Published June 13, 2024Industry supports GDP growth in 3QFY24

Published June 13, 2024MEBL: 1QCY24 Conference Call Key Takeaways

Published June 13, 2024MCB: 1QCY24 Conference Call Key Takeaways

Published May 8, 2024FFBL: 1QCY24 Analyst Briefing Key Takeaways

Published May 3, 2024OMCs: Industry volumes decline 4.7% YoY in Apr-24, 10MFY24 decline now stands at 10.9%

Published May 3, 2024LUCK: 3QFY24 Analyst briefing key takeaways

Published May 2, 2024Economy: Sustained policy and reforms critical for sustainable growth

Published April 30, 2024Economy: SBP to assess IMF talks and budgetary outcomes before monetary easing

Published April 29, 2024FFC: 1QCY24 EPS clocked in at PKR 8.27, up 36% YoY; DPS PKR 5.50

Published April 29, 2024PPL: 3QFY24 EPS clocked in at PKR 10.2, down 15% YoY, DPS PKR 1.00

Published April 29, 2024HUBC: 3QFY24 EPS came in at PKR 13.25, up 53% YoY, DPS PKR 2.50

Published April 29, 2024MARI: 3QFY24 earnings clocked in PKR 105.9/share, down 14% YoY

Published April 29, 2024HUBC: 3QFY24 EPS likely to come at PKR 12.74, up 47% YoY, DPS PKR 5.00

Published April 26, 2024FFC: 1QCY24 EPS expected to come at PKR 8.47, up 39% YoY, DPS PKR 5.50

Published April 26, 2024HBL: Conference Call Key Takeaways

Published April 26, 2024CHCC: 3QFY24 EPS came in at PKR 6.40, down 2% YoY

Published April 25, 2024MARI: 3QFY24 earnings to clock in at PKR 127.7/share, up 4% YoY

Published April 25, 2024FFBL: 1QCY24 EPS clocked in at PKR 3.33

Published April 25, 2024POL: 3QFY24 earnings clocked in at PKR 43.5/share, down 24% YoY

Published April 25, 2024BAHL: 1QCY24 EPS clocked in at PKR 9.01, down 5% YoY, DPS PKR 3.50

Published April 25, 2024FFBL: 1QCY24 EPS likely to clock in at PKR 3.43

Published April 24, 2024POL: 3QFY24 earnings likely to clock in at PKR 26.6/share, down 54% YoY

Published April 24, 2024BAFL: 1QCY24 EPS came in at PKR 6.28, down 8% YoY, DPS PKR 2.00

Published April 24, 2024MCB: 1QCY24 EPS clocked in at PKR 13.97, up 27% YoY; DPS PKR 9.00

Published April 24, 2024BAHL: 1QCY24 EPS to clock in at PKR 9.82, up 4% YoY, DPS PKR 5.00

Published April 24, 2024CHCC: 3QFY24 EPS expected to clock in at PKR 7.27, up 11% YoY

Published April 23, 2024BAFL: 1QCY24 EPS likely to clock in at PKR 5.90, down 13% YoY

Published April 23, 2024HBL: 1QCY24 EPS clocked in at PKR 10.10, up 12% YoY; DPS PKR 4.00

Published April 23, 2024FCCL: 3QFY24 EPS clocked in at PKR 0.72, down 6% YoY

Published April 23, 2024FCCL: 3QFY24 EPS is expected at PKR 0.74, down 3% YoY

Published April 23, 2024MCB: 1QCY24 EPS expected at PKR 12.44, up 13% YoY; DPS PKR 9.00

Published April 23, 2024Material Information: First ever oil discovery in Mari Field

Published April 22, 2024DGKC: 3QFY24 EPS came in at PKR 2.69

Published April 19, 2024EFERT: 1QCY24 EPS came in at PKR 8.08; DPS PKR 8.0

Published April 18, 2024DGKC: 3QFY24 EPS is expected to clock in at PKR 0.62, down 77%

Published April 18, 2024MEBL: 1QCY24 EPS clocked in at PKR 14.18, up 65% YoY; DPS PKR 7.00

Published April 18, 2024Material Information: Successful drilling of Appraisal well

Published April 18, 2024EFERT: 1QCY24 EPS likely to clock in at PKR 5.03; DPS PKR 6.0

Published April 18, 2024MEBL: 1QCY24 EPS likely to come at PKR 13.06, up 52% YoY; DPS PKR 8.0

Published April 17, 2024UBL: 1QCY24 EPS clocked in at PKR 12.73, up 12% YoY; DPS PKR 11.00

Published April 17, 2024UBL: 1QCY24 EPS likely to clock in at PKR 9.33, down 18% YoY; DPS PKR 9.00

Published April 16, 2024OMCs: Industry volumes rose 4.3% YoY in Mar-24, 9MFY24 decline now stands at 11.4%

Published April 8, 2024Cement: Dispatches grow on higher exports

Published April 4, 2024Economy: Mar-24 NCPI clocked in at 20.7% YoY

Published April 2, 2024Economy: Industry contraction weighs heavy on GDP growth in 2Q

Published April 1, 2024Economy: Real Interest rate to turn positive in Mar-24

Published March 28, 2024BAFL: Analyst Briefing Key Takeaways

Published March 21, 2024NBP: Pension outflow to keep dividend paying capacity in check

Published March 21, 2024Economy: Staff level agreement to pave the way for a medium-term program

Published March 20, 2024Economy: MPC sticks to status quo on susceptible inflation outlook

Published March 19, 2024Economy: MPC likely to persist with the wait & see approach

Published March 8, 2024Habib Bank Limited: Conference Call Key Takeaways

Published March 7, 2024Economy: Feb-24 NCPI clocked in at 23.1% YoY on high base & deflating food

Published March 1, 2024Economy: CPI to hit 17-month low in Feb-24

Published February 27, 2024MLCF: 2QFY24 EPS clocked in at PKR 2.1, down 23% YoY

Published February 21, 2024CHCC: 2QFY24 EPS reported at PKR 9.62, up 20% YoY; DPS PKR 1.50

Published February 16, 2024HUBC: 2QFY24 EPS clocks in at PKR 11.78, up 15% YoY, DPS PKR 4.00

Published February 14, 2024EFERT: 4QCY23 EPS likely to clock in at PKR 8.15; DPS PKR 8.00

Published February 13, 2024Cement: Dispatches decline on prolonged fog

Published February 7, 2024MCB: 4QCY23 EPS reported at PKR 13.05, up 20% YoY; DPS PKR 9.0

Published February 6, 2024POL: 2QFY24 earnings clocked in at PKR 27.7/share, DPS at PKR 25.0

Published February 6, 2024Economy: Jan-23 NCPI clocked in at 28.3% YoY

Published February 1, 2024BAFL: 4QCY23 EPS arrives at PKR 5.84, up 124% YoY, DPS PKR 5.00

Published February 1, 2024BAHL: 4QCY23 EPS clocked in at PKR 5.43, up 277% YoY; DPS PKR 5.0

Published January 31, 2024Economy: Advancing Fiscal progress in 1HFY24

Published January 31, 2024Fauji Fertilizer Company Limited: Analyst Briefing Key takeaways

Published January 30, 2024Economy: MPC persists with the wait & see approach

Published January 29, 2024MARI: 2QFY24 EPS clocks in at PKR 137.6, up 65% YoY, DPS at PKR 98.0

Published January 29, 2024Economy: MPC to leave policy rate unchanged

Published January 26, 2024FFBL: 4QCY23 EPS clocked in at PKR 4.11; DPS PKR 1.00

Published January 25, 2024Pakistan Market Strategy: Winning streak to continue through a turbulent CY24

Published January 23, 2024Economy: Pakistan seals executive board approval, unlocking USD 700mn

Published January 12, 2024Economy: Dec-23 CPI clocked in at 29.7% YoY

Published January 1, 2024Economy: CPI to remain sticky at 29.4% YoY

Published December 27, 2023Economy: Status quo likely

Published December 8, 2023Cement: Local dispatches fall resulting from sluggish construction activity

Published December 4, 2023Overall Cement dispatches declined by 3% YoY in Nov-23, on the back of a 16% YoY fall in local dispatches. The decline was in spite of a 4.5x YoY increase in exports. The resetting of external economic equilibrium has rendered cement exports to be relatively more competitive in the international market contributing to the massive 2.0x YoY increase in exports during 5MYFY24. Meanwhile, local dispatches showed a slight 2% YoY recovery for 5MFY24. Consequently, overall dispatches in 5MFY24 experienced a noteworthy double-digit increase of 11% compared to the SPLY.

Economy: Gas Price Hike Elevates CPI reading

Published December 1, 2023As per the latest data released by PBS, headline inflation for Nov-23 registered an uptick to 29.2% YoY in Nov-23 from 26.8% YoY last month. The 5MFY24 average amounted to 28.6% as compared to a 25.1% in the same period of FY-23.

OGDC: FY23 Corporate Briefing Key Takeaways

Published December 1, 2023Economy: Revival of GDP growth

Published November 29, 2023As per estimates by the newly established quarterly GDP dataset, Real GDP growth accelerated by 2.1 % YoY in 1QFY24 as compared to a 0.96% YoY in the same quarter last year. Elevating GDP growth was on account of a (i) 5.1% YoY growth in Agriculture, (ii) a 2.5% YoY recovery in Industry and (iii) a 0.8% YoY growth in services. The uptick was supported by a favorable base effect, even more so, as revised estimates for FY23 indicated a contracting economy with a -0.2% YoY growth.

BAHL: Corporate Briefing Key Takeaways

Published November 27, 2023ECONOMY: Transport to ease CPI in Nov-23 to 26.0% YoY

Published November 24, 2023Strategy: Pakistan reaches IMF staff level agreement

Published November 16, 2023IMF and Pakistan have reached a staff level agreement on the first review under the Stand-By Agreement (SBA) of USD 3bn. This agreement is subject to approval of the IMF’s Executive Board. After approval, Pakistan will receive SDR 528mn (USD 700mn), bringing the total disbursement under the program to USD 1.9bn.

PPL: Corporate Briefing Key Takeaways

Published November 15, 2023DGKC: 1QFY24 EPS clocked in at PKR 1.51, up 70% YoY

Published October 31, 2023KOHC: 1QFY24 EPS settles at PKR 11.38, up 25% YoY

Published October 31, 2023KOHC announced its 1QFY24 results today wherein the company posted an EPS of PKR 11.38 compared to an EPS of PKR 8.88 in 1QFY24, up 25% YoY.

KOHC:1QFY24 EPS is likely to settle at PKR 9.35, up 5% YoY

Published October 31, 2023The board of Kohat Cement is scheduled to meet on 28th October, 2023 to discuss 1QFY24 financial results, where we expect the company to report an EPS of PKR 9.35 for 1QFY24 compared to an EPS of PKR 8.9 in 1QFY23, up 5% YoY.

MLCF: 1QFY24 EPS came in at PKR 1.51, up 18% YoY

Published October 31, 2023MLCF announced its financial result today, wherein the company reported consolidated EPS of PKR 1.51 for 1QFY24 compared to an EPS of PKR 1.28 in 1QFY23, up 18% YoY.

MLCF: 1QFY24 EPS expected at PKR 1.41, up 10% YoY

Published October 31, 2023MLCF is scheduled to announce its 1QFY24 financial result tomorrow, where we expect the company to report an EPS of PKR 1.41 compared to an EPS of PKR 1.28 in 1QFY23, up 10% YoY.

HUBC: 1QFY24 EPS likely to come at PKR 13.47, up 92% YoY

Published October 27, 2023HUBC’s board meeting is scheduled on 25th October, 2023 to consider 1QFY24 financial results. We expect the company to post an EPS of PKR 13.47, up 92% YoY for the 1QFY24.

NPL: 1QFY24 EPS clocked in at PKR 4.12, up 55% YoY

Published October 27, 2023NPL announced its 1QFY24 financial results today, wherein the company posted an EPS of PKR 4.12, up 55% YoY compared to an EPS of PKR 2.66 in SPLY. The result came in higher than our expectation owing to company’s higher O&M savings.

FCCL: 1QFY24 EPS is likely to settle at PKR 0.92, down 3% YoY

Published October 27, 2023FCCL is scheduled to announce its 1QFY24 financial result on 24th October 2023, where we expect the company to report an EPS of PKR 0.92, down 3% YoY, compared to an EPS of PKR 0.94 in 1QFY23.

BAFL: 3QCY23 EPS came in at PKR 5.47, up 60% YoY

Published October 26, 2023BAFL announced its 3QCY23 financial result today, wherein the bank posted an unconsolidated EPS of PKR 5.47, up 60% YoY. This took the 9MCY23 EPS to PKR 17.28, up 93% YoY.

BAHL: 3QCY23 EPS clocked in at PKR 10.07, up 110% YoY; DPS PKR 4.50

Published October 26, 2023BAHL announced its 3QCY23 financial result today. Wherein, the bank reported an unconsolidated EPS of PKR 10.07, up 110% YoY. This took the cumulative 9MCY23 EPS to PKR 26.35, up 96% YoY. Along with the result, bank announced an interim cash dividend of PKR 4.50/share. This took 9MCY23 payout to PKR 9.00/share.

FFC: 3QCY23 EPS came in at PKR 7.18, up 74% YoY; DPS PKR 3.98

Published October 26, 2023FFC announced its 3QCY23 financial results today, wherein the company reported an unconsolidated EPS of PKR 7.18, up 74% YoY. This took the cumulative 9MCY23 EPS to PKR 17.46, up 50% YoY. Along with the result, company announced an interim cash dividend of PKR 3.98/share taking 9MCY23 payout to PKR 11.39/share.

HBL: 3QCY23 EPS clocked in at PKR 11.34, up 44% YoY; DPS PKR 2.25

Published October 26, 2023For 3QCY23, HBL announced a consolidated EPS of PKR 11.34, up 44% YoY. This took the 9MCY23 EPS to PKR 29.20, up 83% YoY. Along with the result, bank announced an interim cash dividend of PKR 2.25/share, taking the cumulative 9MCY23 payout to 5.75/share.

MCB: 3QCY23 EPS came in at PKR 14.73, up 100% YoY; DPS PKR 8.00

Published October 26, 2023MCB announced an unconsolidated EPS of PKR 14.73 for 3QCY23, up 100% YoY. This took the cumulative 9MCY23 EPS to PKR 37.27, up 123% YoY. Along with the result, the bank announced an interim cash dividend of PKR 8.00/share for the quarter. This took the 9MCY23 cumulative payout to PKR 21.00/share.

UBL: 3QCY23 EPS clocked in at PKR 11.88, up 111% YoY; DPS PKR 11.00

Published October 26, 2023UBL announced its 3QCY23 financial result today, wherein the bank reported an unconsolidated EPS of PKR 11.88, up 111% YoY. This took the 9MCY23 unconsolidated EPS to PKR 33.88, up 118% YoY. Along with the result, the bank announced an interim cash dividend of PKR 11.00/share for the quarter taking 9MCY23 dividend to PKR 33.00/share.

BAFL: 3QCY23 EPS to clock in at PKR 6.62, up 94% YoY

Published October 25, 2023BAFL is scheduled to announce its 3QCY23 financial result on 26th October, 2023. We expect the bank to post unconsolidated EPS of PKR 6.62, up 94% YoY. This will take the 9MCY23 EPS to PKR 18.43, up 106% YoY.

MCB: 3QCY23 EPS expected to come in at PKR 15.25, up 107% YoY; DPS PKR 8.00

Published October 24, 2023MCB is scheduled to announce its 3QCY23 financial result on October 25, 2023. Wherein, we expect the bank to post an unconsolidated EPS of PKR 15.25, up 107% YoY. This will take the cumulative 9MCY23 EPS to PKR 37.79, up 126% YoY. Along with the result, we expect the bank to announce an interim cash dividend of PKR 8.00/share for the quarter. This will take the 9MCY23 cumulative payout to PKR 21.00/share.

FFBL: 3QCY23 EPS clocked in at PKR 4.11

Published October 24, 2023FFBL announced its 3QCY23 financial result today. Wherein, the company reported an unconsolidated EPS of PKR 4.11, compared to the LPS of PKR 1.31 in 3QCY22. This took the 9MCY23 EPS to PKR 0.27 against an EPS of PKR 1.33 during 9MCY22.

CHCC: 1QFY24 EPS expected to clock in at PKR 5.67, down 26%

Published October 24, 2023CHCC’s board meeting is scheduled on 23rd October 2023 to consider its 1QFY24 financial results. The company is expected to report an EPS of PKR 5.67 in 1QFY24 compared to an EPS of PKR 7.63 in 1QFY23, down 26% YoY.

NPL: 1QFY24 EPS expected to clock in at PKR 2.99, up 12%; DPS PKR 2.00

Published October 24, 2023NPL is scheduled to announce its 1QFY24 financial results on 23nd October 2023, where we expect the IPP to post an EPS of PKR 2.99, up 12% YoY. Along with the result the IPP is expected to post an interim dividend of PKR 2.00/share.

HBL: 3QCY23 EPS likely to settle at PKR 11.29, up 44% YoY; DPS PKR 2.00

Published October 24, 2023HBL is scheduled to announce its 3QCY23 financial results on 25th October, 2023. We expect the bank to post consolidated EPS of PKR 11.29 during 3QCY23, up 44% YoY. This would take 9MCY23 EPS to PKR 29.15, up 83% YoY. Along with the result, we expect the bank to announce an interim cash dividend of PKR 2.00/share, taking cumulative 9MCY23 payout to 5.50/share.

FFC: 3QCY23 EPS expected to clock in at PKR 8.06, up 95% YoY; DPS PKR 5.50

Published October 23, 2023FFC is scheduled to announce its 3QCY23 financial results on 25th Oct, 2023. We expect the company to report unconsolidated EPS of PKR 8.06, up 95% YoY. This would take the cumulative 9MCY23 EPS to PKR 18.34, up 57% YoY. Along with the result, we expect the company to announce an interim cash dividend of PKR 5.50/share taking 9MCY23 payout to PKR 12.91/share.

FFBL: 3QCY23 EPS is expected to settle at PKR 3.15

Published October 20, 2023FFBL is scheduled to announce its 3QCY23 results on 24th October, 2023. Wherein, we expect the company to record an unconsolidated EPS of PKR 3.15, compared to the LPS of PKR 1.31 in 3QCY22. This will take the 9MCY23 LPS to PKR 0.68 against an EPS of PKR 1.33 during 9MCY22.

BAHL: 3QCY23 EPS likely to clock in at PKR 8.03, up 67% YoY

Published October 20, 2023BAHL’s BoD meeting is scheduled on October 25, 2023 to consider the financial accounts for 3QCY23. We expect the bank to announce an unconsolidated EPS of PKR 8.03, up 67% YoY. This would take the cumulative 9MCY23 EPS to PKR 24.30, up 80% YoY.

MEBL: 3QCY23 EPS came in at PKR 14.21, up 2.2x YoY; DPS PKR 5.00

Published October 19, 2023MEBL announced its financial result today, wherein the bank posted unconsolidated EPS of PKR 14.21, up 2.2x YoY. This took the 9MCY23 EPS to PKR 32.40, up 103% YoY. Along with the result, bank announced an interim cash dividend of PKR 5.00/share, taking 9MCY23 cumulative payout to PKR 12.00/share.

UBL: 3QCY23 EPS likely to clock in at PKR 11.07, up 96% YoY; DPS PKR 8.00

Published October 19, 2023UBL is scheduled to announce its 3QCY23 financial result on 25th October, 2023. Wherein we expect the bank to report an unconsolidated EPS PKR 11.07, up 96% YoY. This would take the 9MCY23 unconsolidated EPS to PKR 32.57, up 112% YoY. Along with the result, we expect the bank to announce an interim cash dividend of PKR 8.00/share for the quarter taking 9MCY23 dividend to PKR 30.00/share.

MEBL: 3QCY23 EPS likely to come at PKR 11.14, up 74% YoY; DPS PKR 4.00

Published October 18, 2023MEBL’s BoD meeting is scheduled on October 19, 2023 to consider the financial result for 3QCY23. We expect the bank to post unconsolidated EPS of PKR 11.14, up 74% YoY. This will take the 9MCY23 EPS to PKR 29.33, up 84% YoY. Along with the result, we expect the bank to announce an interim cash dividend of PKR 4.00/share, taking 9MCY23 cumulative payout to PKR 11.00/share.

EFERT: 3QCY23 EPS clocked in at PKR 7.17; DPS PKR 6.00

Published October 12, 2023EFERT announced its 3QCY23 financial result today, wherein the company reported a consolidated EPS of PKR 7.17 for 3QCY23 against a consolidated EPS of PKR 3.13 during 3QCY22. This took cumulative 9MCY23 EPS to PKR 11.27, up 57% YoY. Along with the result, company announced an interim cash dividend of PKR 6.00/share for the quarter, taking 9MCY23 payout to PKR 12.50/share.

EFERT: 3QCY23 EPS likely to clock in at PKR 5.40; DPS PKR 5.50

Published October 11, 2023EFERT’s is scheduled to announce its 3QCY23 financial result on 12th October, 2023. Wherein, we expect the company to report a consolidated EPS of PKR 5.40 for 3QCY23 against a consolidated EPS of PKR 3.13 during 3QCY22. This would take the cumulative EPS for 9MCY23 to PKR 9.50, up 32% YoY. Along with the result, we expect the company to announce an interim cash dividend of PKR 5.50/share for the quarter, taking 9MCY23 payout to PKR 12.00/share.

Fertilizer: July-23 Urea offtake up 36% YoY; DAP sales increase by 68% YoY

Published August 24, 2023As per the data released by NFDC, July-23 Urea offtake increased by 36% YoY to 629k tons, while DAP offtake increased to 113k tons up 68% YoY. For 7MCY23, Urea offtake remained flat with meagre increase of 1% YoY to 3.7mn tons, while DAP offtake decreased by 3% YoY to 632k tons.

INDU: 4QFY23 EPS to clock in at PKR 32.03, up 3.9x YoY; DPS PKR 16.00

Published August 24, 2023INDU is scheduled to announce its 4QFY23 financial results on 25th August, 2023. Wherein we expect the company to post an unconsolidated PAT of PKR 2.5bn (EPS PKR 32.03) vs PAT of PKR 3.8bn (EPS 6.48) in SPLY, depicting an increase of 3.9x YoY. This would take the FY23 earnings to PKR 106.38/share, down 47% YoY. Along with the result, INDU is expected to announce final cash dividend of PKR 16.0/share, taking cumulative FY23 dividend to PKR 58.80/share.

BAHL: 2QCY23 EPS clocked in at PKR 6.79, up 62% YoY; DPS PKR 4.50

Published August 23, 2023BAHL announced its 2QCY23 financial result today, wherein the bank reported an unconsolidated EPS of PKR 6.79, up 62% YoY. This took the cumulative 1HCY23 EPS to PKR 16.27, up 88% YoY. Along with the result, the bank announced an interim cash dividend of PKR 4.50/share for 1HCY23.

BAHL: 2QCY23 EPS likely to clock in at PKR 6.12, up 46% YoY

Published August 21, 2023BAHL’s BoD meeting is scheduled on August 23, 2023 to consider the financial accounts for 2QCY23. We expect the bank to announce an unconsolidated EPS of PKR 6.12, up 46% YoY. This would take the cumulative 1HCY23 EPS to PKR 15.60, up 80% YoY.

MEBL: 2QCY23 EPS came at PKR 9.58, up 117% YoY; DPS PKR 4.00

Published August 10, 2023MEBL announced its 2QCY23 financial result today, wherein the bank reported an unconsolidated EPS of PKR 9.58, up 117% YoY. Cumulative 1HCY23 EPS came at PKR 18.20, up 90% YoY. Along with the result, the bank announced an interim cash dividend of PKR 4.00/share, taking 1HCY23 payout to PKR 7.00/share.

BAFL: 2QCY23 EPS clocked in at PKR 5.00, up 114% YoY; DPS PKR 3.00

Published August 10, 2023BAFL announced its 2QCY23 financial result today, wherein the bank reported an unconsolidated EPS of PKR 5.00, up 114% YoY. This took the 1HCY23 unconsolidated EPS to PKR 11.81, up 114% YoY. Along with the result, the bank announced an interim cash dividend of PKR 3.00 for 1HCY23.

MARI: FY23 earnings clocked in at PKR 420.7/share, DPS at PKR 147.0

Published August 9, 2023MARI Petroleum announced FY23 financial results today, wherein the company reported an EPS of PKR 420.7/share, up 70% YoY. The result is in line with our expectations. The earnings growth is primarily driven by growth in hydrocarbon production and 28% YoY PKR devaluation. Along with the result, the company also announced a final cash dividend of PKR 58/share, taking the cumulative payout to PKR 147/share during FY23.

MEBL: 2QCY23 EPS likely to come at PKR 9.75, up 1.2x YoY; DPS PKR 3.50

Published August 9, 2023MEBL’s BoD meeting is scheduled on August 10, 2023 to consider the accounts for 2QCY23. We expect the bank to post unconsolidated EPS of PKR 9.75, up 1.2x YoY. This will take the 1HCY23 EPS to PKR 18.36, up 92% YoY. Along with the result, we expect the bank to announce an interim cash dividend of PKR 3.5/share, taking 1HCY23 cumulative payout to PKR 6.50/share.

BAFL: 2QCY23 EPS likely to clock in at PKR 4.72, up 102% YoY; DPS PKR 4.50

Published August 7, 2023BAFL is scheduled to announce its 2QCY23 financial result on 10th August, 2023. We expect the bank to post unconsolidated EPS of PKR 4.72, up 102% YoY. This will take the 1HCY23 EPS to PKR 11.53, up 109% YoY. Along with the result, we expect the bank to announce an interim cash dividend of PKR 4.50 for 2QCY23.

FFBL: Approaching an inflection point

Published August 4, 2023We have revised up our estimates on FFBL and recommend ‘BUY’ with June-24 Price Target (PT) of PKR 27/sh, offering an upside of 84%. Fertilizer business contributes PKR 17.7 or 67% to our PT, whereas investment portfolio contributes PKR 8.9 or 33% to our PT.

EFERT: 2QCY23 EPS clocked in at PKR 0.79; DPS PKR 3.00

Published July 27, 2023EFERT announced its 2QCY23 result today, wherein the company announced a consolidated EPS of PKR 0.79 against a consolidated LPS of PKR 0.07 SPLY. Cumulative EPS for 1HCY23, came at PKR 4.09, up 1% YoY. Along with the result, EFERT announced an interim cash dividend of PKR 3.00/share for the quarter, taking 1HCY23 dividend to PKR 6.50/share.

HBL: 2QCY23 EPS likely to settle at PKR 8.20, up 2.5x YoY; DPS PKR 1.50

Published July 25, 2023HBL is scheduled to announce its 2QCY23 financial results on 26th July, 2023. We expect the bank to post consolidated EPS of PKR 8.2 during 2QCY23, up 2.5x YoY. This will take the 1HCY23 EPS to PKR 17.2, up 1.1x YoY. Along with the result, we expect the bank to announce an interim cash dividend of PKR 1.5/share, taking cumulative 1H payout to 3.0/share.

HCAR: 1QMY24 EPS likely to clock in at PKR 0.88, down 81% YoY

Published July 24, 2023HCAR is scheduled to announce its 1QMY24 financial results on 25th July 2023. We expect the company to post an EPS of PKR 0.88, down by 81%

FFBL: 2QCY23 EPS clocked in at PKR 0.37, down 73% YoY

Published July 21, 2023FFBL announced its 2QCY23 results today, wherein the company reported an unconsolidated EPS of PKR 0.43, down 76% YoY. This took the 1HCY23 LPS to PKR 3.83 against an EPS of PKR 2.64 during 1HCY22.

UBL: 2QCY23 EPS reported at PKR 10.14, up 4.3x YoY; DPS PKR 11.00

Published July 19, 2023UBL announced its 2QCY23 financial results today, wherein the bank posted an unconsolidated EPS PKR 10.1, up 4.3x YoY. This took 1HCY23 unconsolidated EPS to PKR 21.5, up 1.2x YoY. Along with the result, the bank announced an interim cash dividend of PKR 11.0/share for the quarter, taking cumulative 1HCY23 dividend to PKR 22.0/share.

FFC: 2QCY23 EPS expected to clock in at PKR 4.90, up 85% YoY; DPS PKR 3.50

Published July 19, 2023FFC is scheduled to announce its 2QCY23 financial results on 25th July, 2023. We expect the company to report unconsolidated EPS of PKR 4.90, up 85% YoY. This would take the cumulative 1HCY23 EPS to PKR 10.97, up 45% YoY. Along with the result, we expect the company to announce an interim cash dividend of PKR 3.50/share taking 1HCY23 payout to PKR 7.76/share.

EFERT: 2QCY23 EPS likely to clock in at PKR 2.75; DPS PKR 3.00

Published July 19, 2023EFERT’s BoD meeting is scheduled on 26th July, 2023 to consider the financial accounts for 2QCY23. We expect the company to report a consolidated EPS of PKR 2.75 for 2QCY23 against a consolidated LPS of PKR 0.07 SPLY. Cumulative EPS for 1HCY23 is likely to clock in at PKR 6.05, up 49% YoY. Along with the result, EFERT is expected to announce an interim dividend of PKR 3.00/share for the quarter, taking 1HCY23 dividend to PKR 6.50/share.

FFBL: 2QCY23 EPS is expected to settle at PKR 0.47, down 66% YoY

Published July 18, 2023FFBL is scheduled to announce its 2QCY23 results on 21st July, 2023. Wherein, we expect the company to record an unconsolidated EPS of PKR 0.47, down 66% YoY. This will take the 1HCY23 LPS to PKR 3.73 against an EPS of PKR 2.64 during 1HCY22.

UBL: 2QCY23 EPS likely to clock in at PKR 8.35, up 4.4x YoY; DPS PKR 6.00

Published July 17, 2023UBL’s BoD meeting is scheduled on 19th July, 2023 to consider the financial results for 2QCY23. We expect the bank to post an unconsolidated EPS PKR 8.4, up 4.4x YoY. This would take the 1HCY23 unconsolidated EPS to PKR 19.7, up 2.03x. Along with the result, we expect the bank to announce an interim cash dividend of PKR 6.0/share for 2Q taking 1HCY23 dividend to PKR 17.0/share.

Federal Budget FY24: An exercise in vain

Published June 12, 2023The Federal Budget FY24 demonstrates a concerning lack of accountability, as it presents a range of unrealistic revenue objectives and substantial rises in expenditures, particularly in government salaries and pensions. The fiscal deficit is likely to witness a significant slippage from the already high budgeted figure of 6.5% and we believe the budget substantially falls short of likely IMF’s mandated fiscal discipline. Over the past five years, a recurring pattern has emerged in the government's budget presentations, where significant deviations from the previous year's targets are observed in subsequent budgets. Given the recurring trend of significant disparities between budgeted and actual figures in the past, and this budget having gone a step ahead, conducting a thorough analytical review of the Federal Budget FY24, is an exercise in vain.

FFBL: 1QCY23 Analyst Briefing Key Takeaways

Published May 8, 2023LUCK: Corporate Briefing Key Takeaways

Published May 3, 2023ACPL: 3QFY23 consolidated EPS clocked in at PKR 3.97, up 24%

Published April 28, 2023PIOC: 3QFY23 EPS reported at PKR 4.18, up 96% YoY

Published April 28, 2023UBL: 1QCY23 EPS clocked in at PKR 11.36, up 46% YoY; DPS PKR 11.00

Published April 28, 2023CHCC: 3QFY23 EPS reported at PKR 6.55, up 19% YoY; DPS PKR 1.50

Published April 28, 2023KOHC: 3QFY23 EPS clocked in at PKR 8.1, down 1% YoY

Published April 28, 2023PIOC: 3QFY23 EPS is likely to settle at PKR 3.53, up 65% YoY

Published April 28, 2023NPL: 3QFY23 EPS estimated to settle at PKR 2.83, down 12% YoY

Published April 28, 2023HUBC: 3QFY23 EPS came in at PKR 8.67, up 22% YoY

Published April 28, 2023MCB: For 1QCY23 reported an EPS of PKR 11.02, up 46% YoY; DPS PKR 6.00

Published April 28, 2023POL: 3QFY23 earnings clocked in at PKR 57.2/share, up 147% YoY

Published April 27, 2023HBL: 1QCY23 EPS clocked in at PKR 9.00, up 56% YoY; DPS PKR 1.50

Published April 27, 2023BAFL: 1QCY23 unconsolidated EPS came at PKR 6.81

Published April 27, 2023FFC: 1QCY23 EPS clocked in at PKR 6.08, up 24% YoY; DPS PKR 4.26

Published April 27, 2023PPL: 3QFY23 EPS clocked in at PKR 12.1, up 61% YoY

Published April 27, 2023OGDC: 3QFY23 EPS clocked in at PKR 15.03, up 50% YoY

Published April 27, 2023UBL: 1QCY23 EPS likely to clock in at PKR 10.42, up 17% YoY; DPS PKR 7.50

Published April 27, 2023MCB: 1QCY23 EPS expected at PKR 11.35, up 51% YoY; DPS PKR 5.50

Published April 26, 2023FFBL: For 1QCY23, reported a LPS of PKR 4.20

Published April 26, 2023HUBC: 3QFY23 EPS likely to come at PKR 9.3, up 31% YoY

Published April 26, 2023ACPL: 3QFY23 consolidated EPS is expected to clock in at PKR 5.42, up 70% YoY

Published April 26, 2023FFC: 1QCY23 EPS expected to come at PKR 6.30, up 28% YoY, DPS PKR 5.10

Published April 26, 2023HBL: 1QCY23 EPS likely to clock in at PKR 10.0, up 73% YoY; DPS PKR 3.0

Published April 26, 2023KOHC: 3QFY23 EPS is likely to settle at PKR 8.96, up 9% YoY

Published April 26, 2023BAFL: 1QCY23 EPS likely to clock in at PKR 4.65

Published April 20, 2023PPL: 3QFY23 EPS to clock in at PKR 10.3, up 38% YoY

Published April 20, 2023OGDC: 3QFY23 EPS expected to clock in at PKR 12.6, up 26% YoY

Published April 20, 2023BAHL: 1QCY23 EPS came at PKR 9.48, up 2.1x YoY

Published April 20, 2023POL: 3QFY23 earnings likely to clock in at PKR 28.3/share, up 22% YoY

Published April 20, 2023CHCC: 3QFY23 EPS to clock in at PKR 6.20, up 13% YoY

Published April 20, 2023DGKC: 3QFY23 EPS comes in at PKR 2.69, down 18% YoY

Published April 19, 2023FCCL: 3QFY23 EPS clocked in at PKR 0.77, up 21% YoY

Published April 19, 2023FFBL: Likely to record a LPS PKR 3.85 for 1QCY23

Published April 19, 2023MEBL: 1QCY23 EPS clocked in at PKR 8.62, up 68% YoY; DPS PKR 3.00

Published April 19, 2023FCCL: 3QFY23 EPS is expected at PKR 0.88, up 75% YoY

Published April 18, 2023DGKC: 3QFY23 EPS is expected to clock in at PKR 1.53, down 53%

Published April 18, 2023MLCF: 3QFY23 EPS clocked in at PKR 1.75, up 20% YoY

Published April 18, 2023BAHL: 1QCY23 EPS to clock in at PKR 5.20, up 16% YoY

Published April 18, 2023MEBL: 1QCY23 EPS likely to come at PKR 8.90, up 73% YoY; DPS PKR 3.0

Published April 17, 2023EFERT: 1QCY23 EPS came at PKR 3.30, down 20% YoY; DPS PKR 3.50

Published April 17, 2023MLCF: 3QFY23 EPS expected to clock in at PKR 2.34, up 61% YoY

Published April 13, 2023EFERT: 1QCY23 EPS to clock in at PKR 3.03, down 27% YoY; DPS PKR 3.00

Published April 12, 2023MLCF: On stronger footings than peers

Published April 6, 2023Fertilizer: Feb-23 Urea offtake decline 5% YoY; DAP sales up 76% YoY

Published April 3, 2023Fertilizer: January-23 Urea offtake up 6% YoY; DAP sales down 15% YoY

Published March 1, 2023- As per the data released by NFDC, Jan-23 Urea offtake increased by 6% YoY to 631k tons, while DAP offtake took a dip of 15% YoY to 96k tons.

UBL: 4QCY22 Analyst Briefing Key Takeaways

Published March 1, 2023- UBL held its 4QCY22 Analyst Briefing on February 28, 2023 to discuss the financial results and future outlook of the bank. To recall, the bank posted an unconsolidated EPS of PKR 10.9, up 64% YoY during 4Q, which took the cumulative CY22 EPS to PKR 26.2, down 4% YoY. Along with the result, the bank announced a final cash dividend of PKR 9.0/share, taking cumulative CY22 DPS to PKR 22.0.

HUBC: 1HFY23 Corporate Briefing Key Takeaway

Published February 28, 2023- HUBC held its analyst briefing today, wherein the management discussed its 1HFY23 financial results and status of the ongoing projects. Main points discussed during the call are presented below.

ACPL: 2QFY23 consolidated EPS clocked in at PKR 4.2, up 87%

Published February 28, 2023- ACPL announced its 2QFY23 financial result today, wherein the company posted a consolidated EPS of PKR 4.2, up 87% YoY, compared to an EPS of PKR 2.3 in 2QFY22. This takes cumulative earnings in 1HFY23 to PKR 5.8/share, up 23% YoY.

POL: 2QFY23 earnings clocked in at PKR 20.9/share, DPS at PKR 20.0

Published February 28, 2023- POL announced its 2QFY23 financial results today, where the company reported an EPS of PKR 20.9, up 5% YoY compared to an EPS of PKR 19.9 in SPLY. The result came in lower than our expectation owing to higher operating expenses and lower other income. This takes 1HFY23 earnings to PKR 50.6/share........

HUBC: 2QFY23 EPS came in at PKR 10.3, up 177% YoY

Published February 27, 2023- HUBC announced its 2QFY23 financial results today, where the company reported consolidated EPS of PKR 10.25, up 177% YoY, as compared to an EPS of PKR 3.7 in corresponding period last year. This takes 1HFY23 EPS to PKR 17.3, up 83% YoY. Along with the result, the company announced an interim DPS of PKR 5.75, taking the cumulative payout to PKR 21.25 in 1HFY23.

APL: 2QFY23 EPS reported at PKR 10.0, down 70% YoY, DPS at PKR 12.5

Published February 27, 2023- APL announced its 2QFY23 financial results today, where the company posted an EPS of PKR 10.0, down 70% YoY, primarily due to inventory loss booked during 2QFY23 as against inventory gains in SPLY. The result came in higher than our expectation owing to lower-than-expected inventory loss and operating expenses. Along with the result, company announced an interim cash dividend of PKR 12.5/share.

PPL: 2QFY23 EPS clocked in at PKR 8.15, up 55% YoY, DPS at PKR 1.0

Published February 27, 2023- PPL announced its 2QFY23 financial results today, wherein the company reported consolidated EPS of PKR 8.15, up 55% YoY. The increase in earnings is attributable to 10% YoY higher crude oil price and 22% YoY PKR devaluation. The result came in lower than our expectation primarily due to higher exploration cost and lower other income. This takes 1HFY23 consolidated earnings to PKR 17.8/share, up 56% YoY. Along with the result, company announced an interim cash dividend of PKR 1.0/share.

ASL: 2QFY23 LPS reported at PKR 0.7

Published February 27, 2023- ASL announced its 2QFY23 financial results today, wherein the company reported a net loss of PKR 0.7/share, as against an LPS of PKR 0.3 in the SPLY. This takes 1HFY23 LPS to PKR 2.1/share vs an EPS of 0.5 in 1HFY22.

HTL: 2QFY23 LPS clocked in at PKR 0.6/share

Published February 27, 2023- HTL announced its 2QFY23 financial results today, wherein the company reported consolidated LPS of PKR 0.6, as compared to an EPS of PKR 2.1 in corresponding period last year. This decline is mainly attributable to gross margin contraction and elevated finance cost. This will take 1HFY23 LPS to PKR 2.7, against an EPS of PKR 2.8 in SPLY.

- HBL announced its 4QCY22 financial results today, wherein the bank reported a consolidated EPS of PKR 7.3 in 4QCY22, up 28% YoY, compared to an EPS of PKR 5.7 in 4QCY21. The cumulative CY22 EPS clocked in at PKR 23.2 vs PKR 23.8 in CY21. Along with the result, the bank announced a final cash dividend of PKR 1.50/share, taking cumulative CY22 payout to PKR 6.75/share.

HTL: 2QFY23 earnings likely to come at PKR 0.7/share

Published February 24, 2023- HTL’s board meeting is scheduled today to consider 2QFY23 financial results. We expect the company to post consolidated EPS of PKR 0.7, down 69% YoY as compared to EPS of PKR 2.1 in corresponding period last year. This decline in earnings comes from gross margin.....

FCCL: 2QFY23 Corporate Briefing Key Takeaway

Published February 24, 2023- FCCL held its analyst briefing today, wherein the management discussed its 2QFY23 financial results and status on the ongoing projects. Main points discussed during the call are presented below.

ASL: Demand contraction to result in losses during 2QFY23

Published February 23, 2023- ASL’s board meeting is scheduled on February 24, 2023 to consider 2QFY23 financial results. We expect the company to post net loss of PKR 0.7/share, as against an LPS of PKR 0.3 in the SPLY. This will take 1HFY23 LPS to PKR 2.1/share vs an EPS of 0.5 in 1HFY22.

PIOC: 2QFY23 EPS reported at PKR 5.2, up 77% YoY

Published February 23, 2023- PIOC announced its 2QFY23 financial result today, wherein the company posted an EPS of PKR 5.2, up 77% YoY, compared to an EPS of PKR 2.9 in 2QFY22. This takes cumulative earnings in 1HFY23 to PKR 7.8/share, up 54% YoY. The result came in higher than our expectation due to improved gross margins.

HBL: 4QCY22 EPS to clock in at PKR 7.9, up 39% YoY

Published February 23, 2023- HBL is scheduled to announce its 4QCY22 financial results on 24th February 2023. We expect the bank to post consolidated EPS of PKR 7.9 in 4QCY22 up 39% YoY, compared to an EPS of PKR 5.7 in 4QCY21. This would take CY22 EPS to PKR 23.8 vs PKR 23.9 in CY21. Along with the result, we expect the bank to announce final cash dividend of PKR 2.25/share, taking cumulative CY22 payout to PKR 7.50/share.

APL: 2QFY23 LPS likely to clock in at PKR 5.2

Published February 23, 2023- APL’s board meeting is scheduled on February 27, 2022 to consider 2QFY23 financial results. We expect the company to post an LPS of PKR 5.2, compared to an EPS of 33.9 in SPLY, primarily due to inventory losses and turnover tax during the quarter. Along with the result, we expect the company to announce an interim cash dividend of PKR 10/share.

OGDC: 1HFY23 Conference Call Key Takeaways

Published February 22, 2023- OGDC conducted its conference call today following the 1HFY23 financial results announcement, wherein the management discussed its half yearly performance and status of ongoing .............

DGKC: 2QFY23 EPS came in at PKR 1.2, down 57% YoY

Published February 22, 2023- DGKC announced its 2QFY23 financial result today, wherein the company posted an unconsolidated EPS of PKR 1.2, down 57% YoY, compared to an EPS of PKR 2.9 in 2QFY22. This takes cumulative earnings in 1HFY23 to PKR 2.1/share, down 57% YoY. The result came in lower than our expectation possibly due to lower than anticipated increase in retention prices.

UBL: 4QCY22 unconsolidated EPS clocked in at PKR 10.9, up 64% YoY; DPS at PKR 9.0

Published February 22, 2023- UBL announced its 4QCY22 financial results today, wherein the bank posted an unconsolidated PAT of PKR 13.3bn (EPS PKR 10.9) up 64% YoY. This took the cumulative CY22 EPS to PKR 26.2, down 4% YoY. Along with the result, the bank announced a final cash dividend of PKR 9.0/share, taking cumulative CY22 DPS to PKR 22.0.

OGDC: 2QFY23 EPS clocks in at PKR 9.7, up 18% YoY, DPS at PKR 2.25

Published February 22, 2023- OGDC announced its 2QFY23 financial results today, wherein the company reported an EPS of PKR 9.7, up 18% YoY compared to an EPS of PKR 8.2 in SPLY. This earnings growth is primarily due to higher crude oil price (+10% YoY) and PKR devaluation against USD (-22% YoY). This takes 1HFY23 earnings to PKR 22.1/share, up 38% YoY. Along with the result, OGDC announced an interim cash dividend of PKR 2.25/share taking the cumulative payout to 4.0/share in 1HFY23.

PPL: 2QFY23 EPS to clock in at PKR 10.0, up 90% YoY

Published February 22, 2023- PPL’s board meeting is scheduled on February 27, 2023 to consider 2QFY23 financial results, wherein we expect the company to post an EPS of PKR 10.0, up 90% YoY. The increase in earnings can mainly be attributed to 10% YoY higher crude oil prices (averaging at USD 88/bbl) and 22% YoY PKR devaluation (PKR 228/USD). This takes 1HFY23 earnings to PKR 19.6/share, up 72% YoY. Along with the result, company is likely to announce an interim cash dividend of PKR 1.5/share.

MLCF: 2QFY23 EPS clocked in at PKR 2.7, up 53% YoY

Published February 22, 2023- MLCF announced its 2QFY23 financial result today, wherein the company posted a consolidated EPS of PKR 2.7, up 53% YoY, compared to an EPS of PKR 1.8 in 2QFY22. This takes cumulative earnings in 1HFY23 to PKR 4.0/share, up 56% YoY. The result came in higher than our expectation mainly due to higher gross margins.

POL: 2QFY23 earnings likely to clock in at PKR 26.5/share, up 33% YoY

Published February 22, 2023- POL’s board meeting is scheduled on February 27, 2023, to consider 2QFY23 financial results. We expect the company to post an EPS of PKR 26.5, up 33% YoY compared to an EPS of PKR 19.9 in SPLY. This increase in earnings mainly emanates from 10% YoY higher crude oil prices (averaging at USD 88/bbl) and 22% YoY PKR devaluation (PKR 223/USD). This takes 1HFY23 earnings to PKR 56.2/share, up 46% YoY. Along with the result, POL is expected to announce an interim cash dividend of PKR 35/share.

UBL: 4QCY22 unconsolidated EPS to clock in at PKR 7.75, up 17% YoY

Published February 21, 2023- UBL is scheduled to announce its 4QCY22 financial results on 22nd February, 2023. We expect the bank to post an unconsolidated PAT of PKR 9.5bn (EPS PKR 7.8) up 17% YoY. This would take the CY22 EPS to PKR 23.1 down 9% YoY. Along with the result, we expect the bank to announce a final cash dividend of PKR 6.0/share, taking cumulative DPS to PKR 19.0 for CY22.

OGDC: 2QFY23 EPS to clock in at PKR 10.5, up 28% YoY

Published February 20, 2023- OGDC’s board meeting is scheduled on February 22, 2023 to consider 2QFY23 financial results. We expect the company to post an EPS of PKR 10.5, up 28% YoY compared to an EPS of PKR 8.2 in SPLY. This earnings growth is primarily due to higher crude oil price (+10% YoY) and PKR devaluation against USD (-22% YoY). This will take 1HFY23 earnings to PKR 22.9/share, up 43% YoY. Along with the result, OGDC is expected to announce an interim cash dividend of PKR 2.0/share.

PSO: Massive inventory loss & finance cost dent 2QFY23 earnings

Published February 17, 2023- PSO announced its 2QFY23 financial results today, wherein the company posted LPS of PKR 9.7 compared to an EPS of 43.0 in corresponding period last year. This massive decline in earnings can mainly be attributed to inventory losses and elevated finance cost.

KOHC: 2QFY23 EPS clocked in at PKR 9.7, up 25% YoY

Published February 16, 2023- KOHC announced its financial result today, wherein the company reported and EPS of PKR 9.7 during 2QFY23, up 23% YoY, compared to PKR 7.9 in 2QFY22. This takes cumulative earnings in 1HFY23 to PKR 18.6/share, up 25% YoY.

MEBL: 4QCY22 EPS increased by 87% YoY to PKR 9.2; DPS at PKR 3.0

Published February 16, 2023- MEBL announced its 4QCY22 financial results today. During the 4Q, the bank has posted unconsolidated PAT of PKR 16.4bn (EPS PKR 9.2), up 87% YoY. This took the CY22 cumulative EPS to PKR 25.1, up 59% YoY. Along with the result, the bank announced a final cash dividend of PKR 3.0/share, taking CY22 cumulative payout to PKR 8.2/share.

BAHL: 4QCY22 EPS clocked in at PKR 1.4, down 66% YoY; DPS at PKR 7.0

Published February 15, 2023- BAHL announced its 4QCY22 financial results today, wherein the bank reported an unconsolidated EPS of PKR 1.4, down 66% YoY. This took cumulative CY22 EPS to PKR 14.9, down 11% YoY. Along with the result, the bank announced a cash dividend of PKR 7.0/share.

HUBC: 2QFY23 EPS likely to come at PKR 9.4, up 153% YoY

Published February 15, 2023- HUBC’s board meeting is scheduled on 16th February, 2023 to consider 2QFY23 financial results. We expect the company to post an EPS of PKR 9.4, up 153% YoY vs EPS of PKR 3.7 in SPLY. This will take 1HFY23 earnings to PKR 16.4/share, up 74% YoY. Along with the result, we anticipate a dividend of PKR 2.0/share, taking cumulative payout to PKR 18.5/share in 1HFY23.

CHCC: 2QFY23 EPS reported at PKR 8.0, up 32% YoY

Published February 15, 2023- CHCC announced its 2QFY23 financial results today, wherein the company posted an EPS of PKR 8.0, up 32% YoY, compared to an of EPS 6.1 in 2QFY22. This takes cumulative 1HFY23 EPS to PKR 15.6 vs an EPS of PKR 12.2 in SPLY, up 28% YoY.

MEBL: 4QCY22 EPS likely to clock in at PKR 6.3, up 29% YoY

Published February 15, 2023- MEBL is scheduled to announce its 4QCY22 financial results on 16th February, 2023. We expect the bank to post unconsolidated PAT of PKR 11.4bn (EPS PKR 6.3), up 29% YoY during 4QCY22. This would take the CY22 cumulative EPS to PKR 22.3, up 41% YoY. Along with the result, we expect the bank to announce a final cash dividend of PKR 2.0/share, taking cumulative payout to PKR 7.2/share in CY22.

PSO: 2QFY23 EPS expected to clock in at PKR 5.5, down 87% YoY

Published February 15, 2023- PSO’s board meeting is scheduled on February 17, 2023 to consider 2QFY23 financial results. We expect the company to report an EPS of PKR 5.5, down 87% YoY compared to EPS of 43.0 in SPLY. This massive decline in earnings can mainly be attributed to inventory losses.

FCCL: 2QFY23 EPS clocked in at PKR 1.1, up 64% YoY

Published February 14, 2023- FCCL announced its 2QFY23 financial results today, wherein the company reported an EPS of PKR 1.1, up 64% YoY compared to an EPS of PKR 0.7 in SPLY. This takes 1HFY23 earnings to PKR 2.1/share, up 34% YoY. The result came in higher than our expectation largely due to lower effective tax rate.

BAHL: 4QCY22 EPS likely to increase by 9% YoY to PKR 4.7

Published February 14, 2023- BAHL is scheduled to announce its 4QCY22 financial results on 15th February, 2023. We expect the bank to report unconsolidated PAT of PKR 5.2bn (EPS PKR 4.7), up 9.3% YoY. This would take cumulative EPS for CY22 to PKR 18.2, up 7.9% YoY. Along with the result, we expect the bank to announce a final cash dividend of PKR 6.0/share.

NPL: 2QFY23 EPS clocked in at PKR 3.1, up 48% YoY

Published February 13, 2023- NPL announced its 2QFY23 financial results today, wherein the company posted an EPS of PKR 3.1, up 48% YoY compared to an EPS of PKR 2.1 in SPLY. This takes 1HFY23 earnings to PKR 5.8/share, up 23% YoY. The result came in higher than our expectation owing to company’s higher OM efficiency. Along with the result, NPL announced interim cash dividend of PKR 2.0/share, taking cumulative payout to 4.0/share in 1HFY23.

INDU: 2QFY23 earnings reported at PKR 16.9/share, DPS at 10.2

Published February 13, 2023- INDU announced its 2QFY23 financial results today, wherein the company posted an unconsolidated PAT of PKR 1.3bn (EPS PKR 16.9) vs PAT of PKR 4.7bn (EPS 60.4) in SPLY, depicting a 71% YoY decline in profitability. This takes 1HFY23 earnings to PKR 33.4/share, down 74% YoY. Along with the result, INDU announced interim cash dividend of PKR 10.2/share. This takes cumulative 1HFY23 dividend to PKR 18.4/share.

NPL: 2QFY23 EPS estimated to settle at PKR 2.6, up 25% YoY

Published February 10, 2023- NPL’s board meeting is scheduled on February 13, 2023 to consider 2QFY23 financial results. We expect the IPP to post an EPS of PKR 2.6, up 25% YoY compared to EPS of PKR 2.1 in corresponding period last year. This will take 1HFY23 EPS to PKR 5.3, up 13% YoY vs PKR 4.69 during SPLY. Along with the result, we expect the company to announce an interim cash dividend of PKR 1.0/share

EFERT: 4QCY22 Result Review & Analyst Briefing Takeaways

Published February 9, 2023- EFERT announced its 4QCY22 financial results today, wherein the company reported consolidated EPS of PKR 4.80 up 4% YoY. This takes CY22 earnings to PKR 11.98/share, down 24.1% YoY. Along with the result, EFERT announced a final cash dividend of PKR 5.0/share, taking the cumulative dividend to PKR 13.5/share during CY22.

INDU : 2QFY23 earnings to clock in at PKR 20.5/share, DPS at 10.0

Published February 9, 2023- INDU’s board meeting is scheduled on February 10, 2023 to consider 2QFY23 financial result. We expect the company to announce an EPS of PKR 20.5, down 66% YoY. This will take 1HFY23 earnings to PKR 37.0/share, down 71% YoY. Along with the result, company is expected to announce an interim cash dividend of PKR 10.0/share in addition to PKR 8.2/share already announced in 1QFY23.

FFBL: Analyst Briefing Key Takeaways

Published February 9, 2023- FFBL conducted its CY22 analyst briefing yesterday, wherein the management discussed company’s financial results and future outlook. To recall, FFBL reported unconsolidated EPS of PKR 0.48, up 155% YoY during 4QCY22, while the cumulative EPS for CY22 clocked in at PKR 1.80, down 64% YoY.

MCB: 4QCY22 EPS reported at PKR 10.88, up 56% YoY; DPS PKR 6.0

Published February 8, 2023- MCB announced its 4QCY22 financial result today, wherein the bank posted an unconsolidated EPS of PKR 10.88, up 56% YoY. This took cumulative CY22 EPS to PKR 27.63, up 6% YoY. Along with the result, the bank announced a final cash dividend of PKR 6.0/share, taking the total payout to PKR 20.0/share for CY22.

MCB: 4QCY22 EPS expected at PKR 8.49, up 22% YoY; DPS PKR 6.0

Published February 7, 2023- MCB is scheduled to announce its 4QCY22 result tomorrow. We anticipate, the bank to post an unconsolidated EPS of PKR 8.49, up 22% YoY. This would take CY22 EPS to PKR 25.24, down 3% YoY. Along with the result, we expect the bank to announce final cash dividend of PKR 6.0/share, taking cumulative payout to PKR 20.0/share for CY22.

FFC: Analyst Briefing Key takeaways

Published February 7, 2023- FFC conducted its analyst briefing session today to discuss 4QCY22 financial results and future outlook of the company. Earlier, the company had reported an EPS of PKR 4.09, down 13% YoY in 4Q. Cumulative EPS for CY22 declined by 8% YoY to PKR 15.76. During CY22, company’s cumulative dividend payout came in at PKR 12.13 vs PKR 14.50 in CY21.

BAFL: 4QCY22 EPS clocks in at PKR 2.3 up 10% YoY; DPS at PKR 2.5

Published February 2, 2023- BAFL announced its financial result today, wherein the bank reported an EPS PKR 2.3 in 4QCY22 against an EPS PKR 2.1 in 4QCY21. This takes CY22 EPS to PKR 10.2, up 28% YoY. Along with the result, BAFL announced final cash dividend of PKR 2.5/share, taking cumulative DPS to PKR 5.0 in CY22.

BAFL: 4QCY22 EPS to clock in at PKR 3.1, DPS at PKR 3.0

Published February 1, 2023- BAFL is scheduled to announce its CY22 financial result on February 2, 2023. We expect the bank to post unconsolidated profit after tax of PKR 5.5bn (EPS PKR 3.1) in 4Q vs profit after tax of PKR 3.7bn (EPS PKR 2.1) in SPLY. This will take CY22 EPS to PKR 11.0, up 38% YoY. Along with the result, we expect the bank to announce final cash dividend of PKR 3.0/share.

LUCK: Corporate Briefing Key Takeaways

Published January 30, 2023- LUCK held its analyst briefing today to discuss its 1HFY23 financial results. The company reported consolidated earnings of PKR 49.32/share, up 21% YoY during the 1HFY23 (PKR 32.51/share in 2Q). The result is higher than our expectation mainly due to higher share of profit from associates as well as lower effective tax rate and lower distribution cost

FFC: 4QCY22 EPS settled at PKR 4.1, down 13% YoY; DPS at PKR 3.15

Published January 30, 2023- FFC announced its 4Q financial results today, wherein the company reported profit after tax of PKR 5.2bn (EPS PKR 4.09), down 13% YoY. This takes cumulative CY22 EPS to PKR 15.76, down 8% YoY. Along with the result, company announced final dividend of PKR 3.15/share, taking CY22 cumulative DPS to PKR 12.13.

FFBL: 4QCY22 EPS clocks in at PKR 0.48; up 155% YoY

Published January 30, 2023- FFBL announced its 4Q financial results today wherein the company reported unconsolidated EPS of PKR 0.48, up 155% YoY against an EPS of PKR 0.19 in SPLY. This takes cumulative CY22 EPS to PKR 1.80, down 64% YoY. The result was below our expectation primarily due to lower than anticipated gross margins and impairment on equity investments booked by the company.

Cement: Higher retention prices to pave the way for improved profitability

Published January 30, 2023- With result season around the corner, we present result previews of Akseer cement universe. We expect profitability of our sample companies to increase by 15% YoY to PKR 12.5bn during 2QFY22.

Fertilizer: December-22 Urea offtake up 39% YoY; DAP sales up 35% YoY

Published January 30, 2023- As per the data released by NFDC, Dec-22 Urea offtake increased by 39% YoY to 833k tons, while DAP offtake rebound to 158k tons up 35% YoY. For CY22, Urea offtake increased by 4% YoY to 6.6mn tons, while DAP offtake declined by 36% YoY to 1.2mn tons.

ISL: 2QFY23 LPS clocks in at PKR 0.89

Published January 27, 2023- ISL announced its 2QFY23 financial results today where the company reported net loss of PKR 388mn (LPS PKR 0.89) as against PKR 1.6bn in the SPLY. The result is significantly lower than our expectation owing to more than estimated contraction in gross margins. This takes 1HFY23 EPS to PKR 0.14, down 99% YoY.

Fertilizer: Higher Urea offtake during 4Q to lift sector’s profitability

Published January 27, 2023- With the onset of result season, we present result preview of Akseer Fertilizer universe. We expect profitability of our sample companies to increase by 40% YoY to PKR 23.6bn during 4QCY22.

ISL: 2QFY23 EPS likely at PKR 1.1, down 68% YoY

Published January 26, 2023- ISL’s board meeting is scheduled on January 27, 2023 to consider 2QFY23 financial results. We expect the company to post net earnings of PKR 1.1/share, down 68% YoY as against an EPS of PKR 3.6 in the SPLY. This decline in earnings can mainly be attributed to lower volumetric sales, gross margin contraction amid higher production cost and increase in finance cost. This will take 1HFY23 earnings to PKR 2.2/share, down 78% YoY. Along with the result, we expect ISL to announce an interim dividend of PKR 1.0/share.

MARI: 2QFY23 EPS likely to clock in at PKR 92.3, up 65% YoY, DPS at PKR 102.0