How to Invest Your First Rs. 5,000 in Stock Market

Published October 31, 2022The temptation of handsome profits has enticed people from all walks of life to invest their savings. You do not need a casket full of cash to begin investing. In fact, as a beginner, it makes more sense to start modestly and progressively increase your investment amount as you develop a better understanding of the finer points of investing/trading.

It is important to learn how to evaluate stocks and select the best one for you. Not all stocks are suitable for investment. Some are overvalued, while others may have bad fundamentals, poor corporate governance, or other issues.

Hence, it becomes significant to discover the stocks that can help you earn through dividends or capital appreciation. It is not rocket science; all you need is a little knowledge and practice to make things easy for yourself.

In this article, we will help you with starting your first investment in the stock market. Further, please read this post till the end as there is a bonus in the last section of this article.

-

Start with dividend stocks

What exactly is a dividend stock?

When you purchase dividend stock in a publicly listed company, a percentage of the company’s income, known as a dividend, is delivered to shareholders on a regular basis, typically quarterly.

Dividends are one of the ways for investors to profit from their stock investments. Investing in dividend-paying stocks is a preferred approach over other investment options for various reasons:

- they are less volatile than growth stocks

- can minimize portfolio risk, and

- offer continuous cash flow

When you reinvest dividends, you can use the power of compounding to accumulate additional wealth over time.

To understand how stock dividends work, the first study is about the many forms of dividends that a corporation might use to pay shareholders.

Types of Dividends:

The most prevalent sort of payout is the Regular dividend. Companies often pay a set rate per share of stock held, regardless of the company’s financial performance. Dividend payments are typically made on a regular basis, such as once every quarter.

Secondly, Dividend reinvestment programs also known as (DRIPs) are dividends that are given in the form of extra shares of stock rather than cash, which investors can reinvest back into the firm at a discount.

Thirdly, Variable dividends, unlike normal dividends, the amount of these payments is set by the earnings of a company over a specific time period. They are frequently paid on a steady rhythm, although this is not always the case.

Lastly, Special dividends, where a company may give a one-time payment in the form of a special dividend from time to time. This could be because they’ve been very prosperous or have an excess of cash with no immediate need, and they wish to share their fortune with investors.

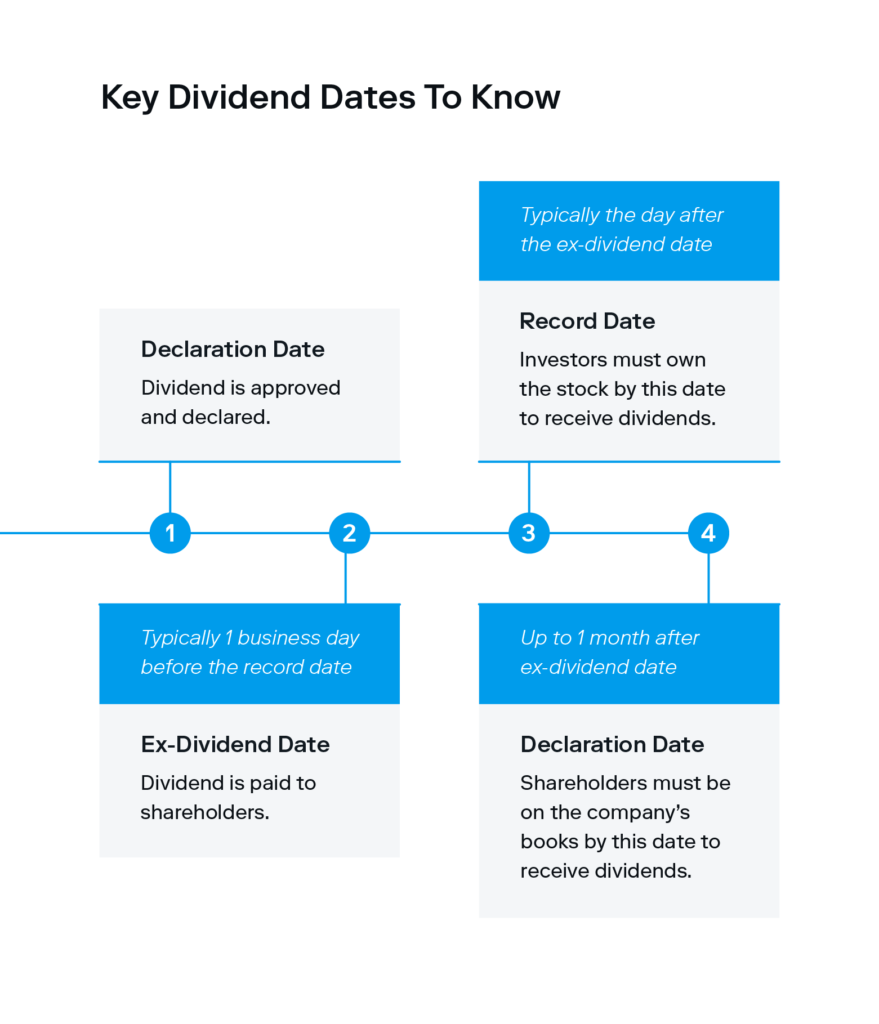

When you own a dividend stock, the company will issue payments based on the type of dividend they offer, usually quarterly. The company’s board of directors must approve each dividend before the payment process can begin.

-

Invest in just one stock

When trying to get as much return as you can for the least amount of risk, your number one concern should be diversification. But, when you’re starting with minimum knowledge and investment, it is recommended to invest in one stock only. There are 3 main advantages of having just one stock in the portfolio:

- It is easier to monitor the stock price and decide when to sell or buy more of the stock. Later, when you’ve learned enough, we advise you to work on portfolio diversification in order to increase your earnings and manage the risk.

- When you select the stock, you understand what you own. You have complete control over what you invest in and when you invest it. This even saves a lot of time of researching different companies.

-

Invest in a company you understand

Stock market investing can be confusing at times but that doesn’t mean that investors should shy away from investing for their future, instead it is advised to always invest in companies you understand and comprehend. Companies continuously post their internal structure and macro environment but an investor only connects to them when they actually understand the company itself.

There are tons of companies whose products/services you have been using already and might be happier with them. Find out those companies and invest in them after proper research.

Bonus Tip

Blue Chip Stocks:

Blue-chip stocks are the shares of large, well-established, and financially solid corporations that have been in operation for a long time. The word “blue chip” refers to the highest-valued blue chip in the game of poker. A blue-chip stock is typically a highly valued and well-known corporation with attributes that benefit investors over time, such as dependable cash flows and consistent dividends.

Blue-chip stocks often have strong balance sheets, consistent cash flows, established business strategies, and a track record of rising dividends. As a result of their track records and performance histories, investors generally consider blue-chip stocks to be among the most secure stock investments. While blue-chips are not immune to losses if the overall stock market falls, the notion is that big names will be less volatile than smaller growth businesses and will also be the first to recover when the market eventually rebounds.

Such stocks can give good and consistent returns. Don’t turn blind eye to these stocks.

Closing Note:

With these extensive tips and tricks, investing your first PKR 5,000/- should be easier and more interesting.

To start with your first investment, you may open a Sahulat Account with minimum requirements. Sahulat account is the best opportunity for housewives, students, and newly employed individuals to invest without having proof of income. You may find complete details here

Keep investing gradually and enjoy your financial freedom!

Leave a Reply